Suntec Real Estate Investment Trust (SGX: T82U) is a commercial real estate investment trust. The Trust invests in income-producing real estate that is primarily used for retail and/or office purposes. It currently has interests in retail malls and offices in Singapore and Australia. Its portfolio includes Suntec City, a one-third interest in One Raffles Quay, a commercial building in Sydney and a 50% stake in Southgate Complex in Melbourne, just to name a few.

Here Multi Management Future Solutions research two things as per the trader's interest in this Singapore REIT that investors may want to know about right now: its latest financial performance and valuation.

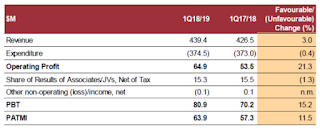

Suntec REIT’s financial performance for the third quarter of fiscal year ending December 2018. The gross revenue of its Q3 in 2017 was S$91,132 and in 2018 its change -2.5% to S$ 88,811. Net Property income its Q3 in 2017 was S$ 63,852 and change -11.4 to S$ 56,544 in 2018 and Income contribution from JVs S$ 22,254, change 4.1 to S$ 23,159 in 2018.

During the quarter, net property income declined year-on-year due to lower income from certain properties, weakened Australian dollar and higher expenses as a result of sinking fund contribution. On the other hand, income from joint ventures increased due to the acquisition of additional interest in Southgate Complex.

As of 30 September 2018, the REIT’s gearing stood at 38.2% while its committed occupancy rates for office and retail properties stood at 98.9% and 98.1% respectively.

The valuation data of Suntec Real Estate Investment Trust shows two useful valuation metrics for assessing REITs. They are the price-to-book (PB) ratio and the distribution yield.

The table below shows Suntec REIT’s PB ratio and distribution yield. It also shows the respective averages for the two valuation metrics for the 42 REITs that are in Singapore’s stock market.

Suntech REIT Average 42 premium is 5.6% distribution yield to book price ratio 0.86% and 7.0% to book price ratio 0.90%.

Which conclude that Suntec REIT is trading at a premium to market average based on its low distribution yield, offset slightly by its low PB ratio.

Here Multi Management Future Solutions research two things as per the trader's interest in this Singapore REIT that investors may want to know about right now: its latest financial performance and valuation.

Suntec REIT’s financial performance for the third quarter of fiscal year ending December 2018. The gross revenue of its Q3 in 2017 was S$91,132 and in 2018 its change -2.5% to S$ 88,811. Net Property income its Q3 in 2017 was S$ 63,852 and change -11.4 to S$ 56,544 in 2018 and Income contribution from JVs S$ 22,254, change 4.1 to S$ 23,159 in 2018.

During the quarter, net property income declined year-on-year due to lower income from certain properties, weakened Australian dollar and higher expenses as a result of sinking fund contribution. On the other hand, income from joint ventures increased due to the acquisition of additional interest in Southgate Complex.

As of 30 September 2018, the REIT’s gearing stood at 38.2% while its committed occupancy rates for office and retail properties stood at 98.9% and 98.1% respectively.

The valuation data of Suntec Real Estate Investment Trust shows two useful valuation metrics for assessing REITs. They are the price-to-book (PB) ratio and the distribution yield.

The table below shows Suntec REIT’s PB ratio and distribution yield. It also shows the respective averages for the two valuation metrics for the 42 REITs that are in Singapore’s stock market.

Suntech REIT Average 42 premium is 5.6% distribution yield to book price ratio 0.86% and 7.0% to book price ratio 0.90%.

Which conclude that Suntec REIT is trading at a premium to market average based on its low distribution yield, offset slightly by its low PB ratio.